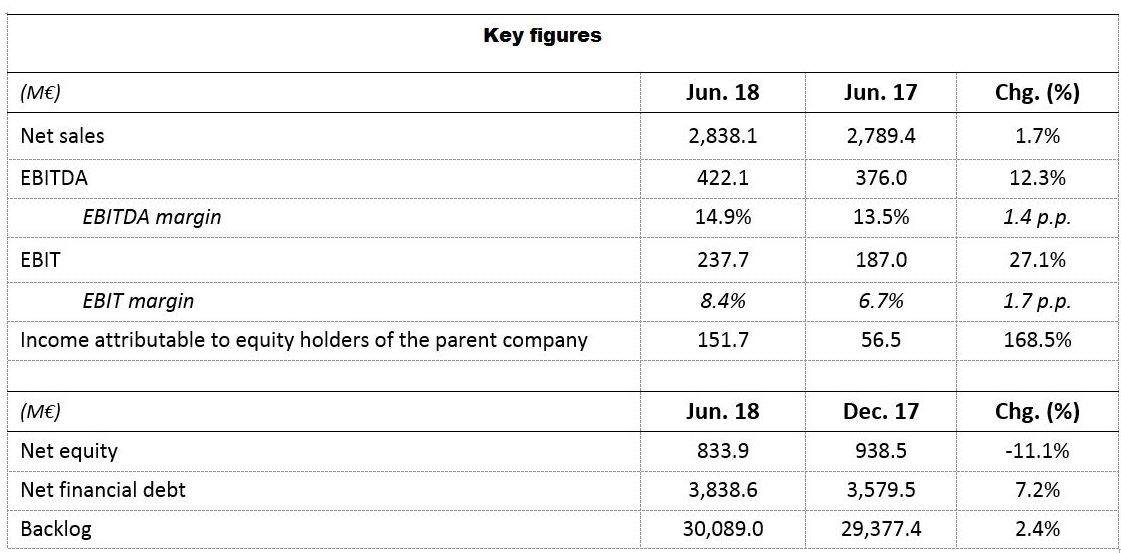

FCC increased net attributable profit in the first half to €151.7 million

- FCC's EBITDA increased by 12.3% to €422.1 million, compared with €376 million the previous year

- Group revenues amounted to €2,838.1 million, a 1.7% increase year-on-year

FCC reported €151.1 million in net profit in the first half of 2018, an increase of 168% with respect to the same period of 2017. This result was supported by good operating performance in all business areas and a reduction in the cost of the company's funding structure.

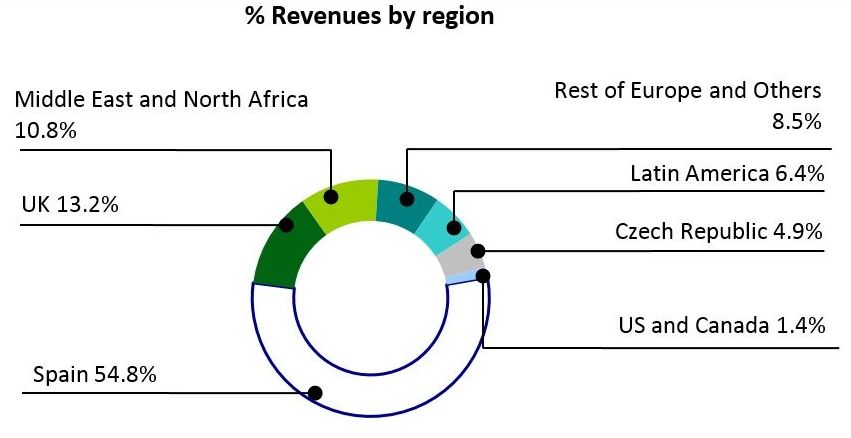

Group revenues amounted to €2,838.1 million, a 1.7% increase year-on-year. This increase was attributable broadly to the Environment and Water divisions. As a result, the FCC Group increased revenues by 4% at constant exchange rates with respect to the same period of 2017.

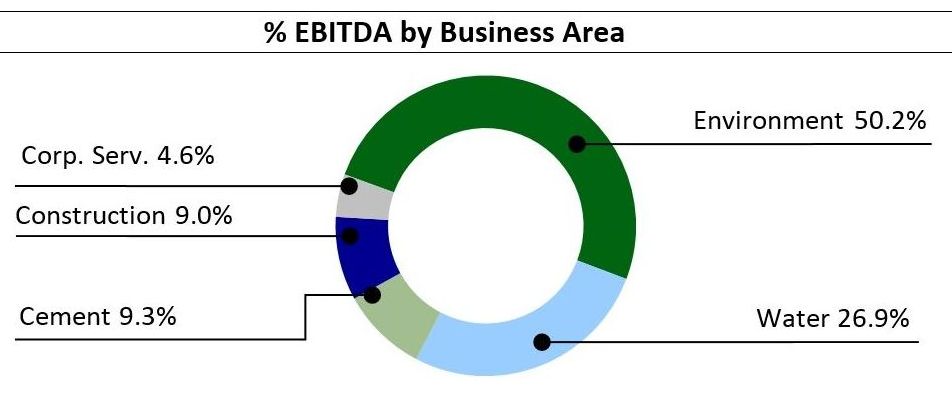

EBITDA amounted to €422.1 million in the first half, a 12.3% increase on the €376 million reported in the same period of 2017. The EBITDA margin increased by 1.4 percentage points to 14.9%, one of the highest levels ever achieved by the FCC Group.

Environmental Services reported €212 million in the first half, an 8.8% increase on the same period of last year, basically as a result of the increased contribution by higher-margin businesses (recycling and incineration), particularly in international markets.

The Water business reported €113.7 million, 3.3% more than in the first half of 2017. EBITDA in the Construction area amounted to €37.8 million, 12.5% more than the previous year, while the EBITDA margin improved steadily to 5.1%, compared with 4.4% in 2017. The Cement division expanded EBITDA by 32.1% to €39.1 million due to better performance in Spain.

Net financial expenses were cut by 24.7% to €82.5 million in the period. This sharp reduction was the result of lower funding costs, achieved through a number of measures to refinance and optimise finances in the last year.

Milestones in the first half

FCC Construction wins two road contracts in Panama worth USD 892 million

In June, a consortium comprising FCC Construction and CICSA (Grupo Carso's infrastructure and construction division) was awarded a contract for the second section of the Inter-American Highway in Panama, with a budget of USD 349 million. The consortium had already landed the contract to expand section I, with a budget of USD 543 million. The two projects entail adding extra lanes, upgrading interconnections with other roads and improving traffic flow. The work, which will be executed along 50 kilometres of the highway, is scheduled to take over 20 months.

As a result, the area's order intake in the first half of 2018 amounted to €1,3 billion, 2.5 times the figure for the same period of last year, representing over three years of work.

FCC advances towards closure of the sale of 49% of Aqualia to IFM for €1,024 million.

In March, FCC agreed to sell a minority stake in FCC Aqualia, the parent company of its Water division, to IFM Global Infrastructure Fund. The main features of the transaction are as follows: (i) the FCC Group is selling 49%; consequently, it retains control of the subsidiary. (ii) IFM is to pay €1,024 million for 49% of Aqualia, which implies that 100% of Aqualia is worth €2,090 million. (iii) Completion of the deal is subject to the usual conditions precedent (competition, authorisation from the financial authorities, etc.). (iv) The proceeds will be used mainly to pay down debt and, to a lesser extent, to cover other funding needs in the group. (v) FCC Aqualia, the head of the Water division, plans to maintain its current strategy, operations and commercial relations (with public administrations, private customers, suppliers, etc.), while strengthening and developing new markets, benefiting from the active involvement of its new shareholder, the resulting synergies, and the continuity of the company's current management.

The deal is expected to be completed in the next few months, once the regulatory approvals have been obtained and standard procedures have been completed.

FCC Environment takes prize at the Awards for Excellence in Recycling and Waste Management 2018

In May, the Re3 MRF, a materials recycling facility in the UK, was the winner in the "Best Use of Design and Technology in a Waste Management Facility" category at the prestigious Let's Recycle Awards for Excellence in Recycling and Waste Management 2018. The award recognised re3's investments and efforts to increase the recovery of reusable waste, particularly plastic. The investments include upgrading the facility to achieve higher recovery rates.

Aqualia obtains first contracts in Panama and Oman

Panama's Ministry of Health has chosen Aqualia's proposal to design, build, operate and maintain the Arraiján Este waste water treatment plant. Worth €75 million, it is the Water division's first project in Panama. In February, SAOC, a joint venture of Aqualia and Majis Industrial Services (owned by Oman Investment Fund), obtained a contract to develop, operate and maintain, for 20 years, all water-related services (capture, desalination, distribution and waste water treatment) in the Sohar port area, the most important district in northern Oman. Revenues over the contract term will amount to close to €120 million.

Refinancing of the Environmental Services business in the UK completed for close to £300 million

FCC Environmental Services UK, the parent company of the Environmental Services division in the UK, completed a combined refinancing deal in June. It issued £207.3 million in 20-year senior debt with an investment grade rating, backed by energy-from-waste (EfW) assets. The parent company in the UK also refinanced £89.4 million in bank debt. This was a pioneering deal as the first portfolio of EfW plants in the UK to obtain an investment grade rating. The deal optimises the area's funding and enhances its growth capacity.